The volatility on global stock exchanges late January-early February seems to have subsided. However, the deeper meaning of this serious turmoil should not be ignored by Marxists. Ana Bazac, a researcher and an activist from Romania, here puts forward her view of the tremor in the markets.

For whom the recent turmoil on the financial markets generated by the fall of main indexes of stock exchanges in New York, Asia and Europe is a danger?

“It’s not a crisis, only a correction”, was the main reassuring slogan of the dominant elites all over the world, while the mood of common people turned at least to worry: because, as it is well-known, the humble are those who pay, and every kind of disturbance, all the more a crisis or war, worsen to disaster their existence; therefore, “we are not happy at all, we are even compassionate for the losers of exchange transactions”.

Of course we are not happy, but ought we to be sympathetic with the stock exchange players? And what does the recent “corrections” mean?

The institution of stock exchange (related to, but different from the commodities exchange) was created as a means of the capital to develop – gather both funds for new businesses and facilitating opportunities of new investments – and also to “socialize” its risks. For the exchange transactions to take place there are two conditions put to the capital aiming at being object of transactions: to be big (proving this calibre with its profit performances) and to accept to “share” the private ownership, by dividing it into stocks/shares of equities, which may be sold to other, national and transnational, companies. Fulfilling these conditions, every capitalist player – then, the capitalist governments too – may list its property/companies in the stock exchange, and thus, it is simply about sale-buying capitalist relations who suppose that the more a company is owned by more/actually, bigger stockholders, the surer would be its property and its profitability; and in case of troubles like bankruptcy, the damages and responsibility would be far lesser.

Because this manner to treat the power of capitalist ownership was very attractive – and it seemed to make a “popular” capitalism – the finding of petty capitals and even respectful wage-earners was to put together their fortune, and so the investment funds (as the pension funds) became also listed and playing in stock exchanges. And since anyone can gain, every man jack would be interested in the good business, and thus, becoming a supporter of the game, wouldn’t it?

To put it more dry: the stock exchange is a rapid (seemingly, impersonal and elegant) manner of the concentration and centralization of the capital, helping the biggest to become bigger and easing the weakest to be swallowed by the former. In other words, the transaction of stocks reflects the capitalist profitable supply-solvable demand: the bigger value of shares shows a higher profitability, but also the magnitude of the owner capital; the cheaper (and more) shares offered to be sold are bought by bigger capitals which, from now on, are bigger than already were and more able to buy more stocks from everywhere and, at the same time, to have a bigger value of their own shares which not anyone may buy.

Certainly, the stock exchange is only a part of the capitalist economic process and thus, it reflects the historical eras of this process and the historical levels of the capital. First: the relationship between the productive capital and the financial one, of banks. From the beginning of modernity, the financial capital was the adjuvant of the productive one: namely, it was subordinated to the productive interests and opportunities. However, and not because of the abstract relative autonomy of every system towards its milieu/surrounding systems, but just in order to better serve the capital needs of an exuberant industrial production, the financial capital (of banks) became subordinated to two, related but different, processes: the one lending money for productive reasons/to productive units, and lending and managing he money of individuals (this was the commercial aspect/face of banks) and the one ruling the amplitude and spread of money (this was the investment face of banks, where the ultimate/main reason of the financial procedures was no longer the, what we call, real economy, but the one of is adjuvant). The investment policies of banks were related just to the development of stock exchanges, the rise of big capitals and their division into shares, and their concentration and centralization.

The autonomy of the financial sector has not so much technical reasons, but political/structural ones: because it is not the result of the technical specificity of the financial operations, but of the quest for profit of the financial owners and institutions as such, therefore not related to the profits realized in the real economy but to the profits related to the buying and selling of money as merchandise, according to the capitalist survey of demand and its solvability, and of the degrees of profitability of different financial investments.

Consequently, the autonomy of the financial sector has manifested as speculation even before the development of the modern financial instruments[i]: there were crises generated/initiated just by financial speculation.

Nevertheless, the autonomy of the financial sector is only relative, i.e. ultimately this sector/the profitability of this sector depend on the well-being of the real capitalist economy. It is true that the financial speculation and the stock market crash were the immediate/direct/visible cause of the Great Depression, for example, but in fact these speculation and crash have showed the state of the real economy and the capitalist logic of the private property: according to this logic, the financial speculation is a better means to produce – and rapidly, and bigger – profit than in the real economy, irrespective of this economy’s situation. Anyway, the crash and the economic crisis have reflected the apparent crisis of over-production in the real economy: in fact, the structural capitalist relations, and especially the ones of exploitation are cyclically producing the peak of the contradiction between the weak, insufficient purchasing power of the many and, on the other hand, the real power of economy/productive forces to satisfy needs; but needs are not tantamount to the economic demand: this one must be solvable. (Consequently, the law of the capitalist economy is not supply and demand, but as it was said above, profitable supply and solvable demand).

When the profitability of the real economy was high – as, for example, after the Second World War, during the welfare state/les trentes glorieuses (the thirty glorious years, as the French called this period) – the investment policies of the financial sector were less aggressive/”innovative” than after: because the real economy offered many profit opportunities. Still, the autonomy of the financial sector gave birth just in this golden era to hedge funds (from 1949 onwards), “flexibly” speculating outside the regulations framing the classical investment policies, by betting on the future conditions of financial businesses[ii], and inherently collapsing in the moments of economic crisis (1969-1970, 1973-1974).

In proportion as the growing international competition and shrinking of the economic “vital space”, the end of post-war reconstruction and the revolution in science and technology have reduced the margins of profits in the real economy, a resolute process of financialisation began: with all the economic regulations, it seemed to the big capital “easier, faster and higher” to obtain money from financial speculation. This is the reason – and this is the essence of financialisation – that the number and value of financial transactions is thousand times greater and higher than the international commodities trade.

From the fatidic years 1989-1991 on, therefore from the moment when the transnationalisation of the capital – i.e. de-localisation of production, deregulation of the behaviours of capital and its relation with the national labour force – or clearer, when the transnational relation of the transnational capital-transnational labour force has no longer encountered any obstacle, the financialisation of the economy has developed exponentially. Why this, when the Western capital has gained a new “vital space” after the collapse of real socialism? Because: and even though capitalism has entered its new phase – the transnational one, meaning new stimuli to capital/its profits – the inherent decreasing of the profit rate as a result of the already mentioned processes of accelerated dissemination of high technologies and shrinking of markets has led to the capital’s copious use of compensating ways. And as before 1989 (see the 1987 crash), the periodically financial crises did not stop the innovation of new “financial products” betting on forecasts of economic and financial profits and on inexistent intermediations of a simple and vulgar buying and selling of signs, artificial money not linked to any real economic process. The entire financial industry creating absurd artificial wealth of the few was the “exuberant” quest for financial profits rising well above the good figures of profit in the real economy.

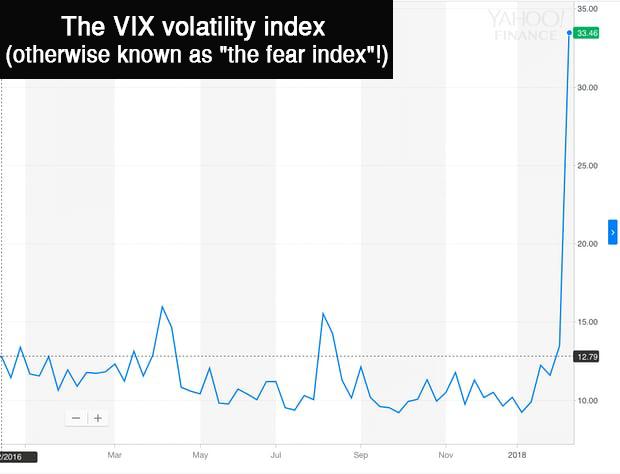

Now, what did happen on February 5 and 8, 2018? From the one hand, the global markets were not so exuberant as before and on the other hand, the selling-off has much surpassed the buying of financial assets. Of course, the profits of exchange houses have fallen a little, but the panic of investors’ selling-off and the transnational contamination of this panic was much important, suggesting to many a new 2008 type crisis.

Concretely, the shares being cheaper than before, because they were offered abundantly, they were bought (not all of them, of course, some owners becoming losers) by the biggest capitals which have enriched by sipping the smaller ones than them.

As a result, on the one hand, a new concentration and centralisation of capital took place, and on the other hand – a reassessment of the values of shares, they becoming “less artificial”: from this last point of view, the crack-up being indeed a “correction”.

However, why did all of these happen now? There are three types of causes.

One is the financial policy as such. The 2008 crisis has imposed some regulations of banks in order to avoid their future incautious behaviour generating disbelief in the health of financial system: the stress tests[iii] imposing to banks increasing provisions for the old loans, a better data collection for safer businesses, a better monitoring of risks. After a while, many banks have complained that the institution of credit as such would be strangled with these constraints. The problem is not that even the stress tests became less rigorous, but that the above regulations tend to be and were reduced[iv], because only this reduction permits a vivid borrowing and lending money for the most part for transacting financial assets: therefore, the recovery of profits.

And that this type of imprudent financial policy was preceded by:

· the Quantitative Easing (the injection by central banks of liquidity into the financial system in order to reduce the interests paid by the investors borrowing from banks for their speculations, and to offer to banks their “raw material” and to oppose inflation, but as we already have experienced the Quantitative Easing did not heal the economies because the impediment was not the lack of liquidities to lend to companies, but the difficulty to have markets),

· by the bail-out (the salvage of private banks with the money of states, generating their debt/so-called the sovereign debt crises),

· by the concomitant reduction of interests paid by banks when borrowing from central banks (in Europe)/control of these interests in order to keep them low but allowing a 2% inflation (in USA)

· by the preventive measure of bail-in (the salvage of private banks – which are, formally and informally, the partners of financial institutions and investment funds speculating/risking – by their depositors, official in Europe from 1 January 2016),

· by the present (controlled) stimulation of a rise of inflation (because deflation means low profits),

· by the above-mentioned regulations aiming at putting some hindrance to the too big speculation, but at the same time, easing just this very big speculation,

all of these[v] show only the structural contradiction between the private financial logic of obtaining profit blow high blow low and, on the other hand, the necessity to pare down its “freedom” in order to assure just its logic but more than on short term.

As we know, the supporters of monetarism (as Milton Friedman)have considered that the cause of modern crises is only financial, and advised that just the (controlled) expansion of money supply (by central banks, and thus by banks for borrowers) would be the solution to not stop the lively quest for business opportunities and the daring of economic practices. Nevertheless, neither the “freedom” of capital towards any regulation started from a precautionary capitalist position, thus nor the deregulation and privatization, and nor the floating exchange rates (in order the state gain from them, and thus allowing the reduction of the taxes of capital) did solve the cyclically crises when the financial aspects were the first visible ones: and which the monetarists did not foresee. The only results of this monetary policy were the strong increase of concentration and centralisation of capital, the development of the ugliness of the consumption economy, polarisation and the continuous economic disorder[vi]. On the contrary, Keynes – who was not monetarist – insisted in his days that just the cheap credit is, on monetary level speaking, the cause of “business cycles”: and just on this basis, he foresaw The Big Depression. But this reflects his different philosophy of economics, the stronger relation between the monetary and the real economy.

Anyway, the other cause of the present shaking of the financial markets is the real capitalist economy and its contradictions between the huge competition for markets, and the reasons of capital to produce more and more in order to obtain profits. In this framework when the money invested in financial speculation seems to be much more profitable, and when the state as such has no longer sufficient money to invest in public infrastructure because it has a “friendly” attitude towards capital concerning its taxation and its priority is to invest in arms and wars, first of all in order to assure the contracts of the military industrial complex, the surplus private capital, discouraged by the economic competition, headed for financial speculation. Some gains of this speculation were and are invested in the policy-making, in order to press for low taxation of the capital and the less financial and economic regulations possible, and certainly, in the military industry in order to have a huge, immediate and sure profit in the real economy. But in the last instance, the military investments are not productive unless they bring about new colonies like before the First World War. And since this is more and more difficult – with all the present aggressive neo-colonialist wars and huge destruction in Africa and Asia – the entire capitalist economic logic once more appears absurd and counter-productive for the economic and social system as such and for most of the populations worldwide.

The third cause of the present financial mess is given by the capital-labour force social relations. As it is known, Marx has revealed the link between the capitalist economic logic and the social condition of the labour force, and his demonstration was and is repudiated by all the economists of the status quo. Concretely, the news about the little increase of wages in USA last year was considered by speculators as threatening the profits of real economy companies and, thus, their own profits. What is important for the (financial) capital is that the economic movements to not encounter any opposition from the labour force and, since the 2008 crisis, this force began to press, and more and more strongly, the capitalist economic edifice. The conclusion of this aspect is that the goals of the whole capital are antagonist to those of the ordinary people: so, either these ones accept to keep quiet and accept the capitalist practices (thus, they ought to not protest for decent wages, pensions, for state expenses for infrastructures and common goods as free education and health care) or they do not accept and impose their own political agenda.

Therefore, and even concerning the crash of stock exchanges, we have to not forget that the capitalist financial performances were and are always on the expense of both the real economy and the social expenditures of states, as well as the social goals of the world working masses. And since these goals are international and at the same time ecological, the entire capitalist economic logic once more appears absurd and counter-productive for the economic and social system as such and for most of the population worldwide.

We all are witnessing the oscillation between different capitalist financial policies all of them promising the solving of the economic disorder and a new era of prosperity: but they are only periodic tactics within the capitalist strategy to gain time and avoid the rising of the working masses. The monetarist “free market” type tactic of cheap money generates crashes. But the central banks’ lifting of interest rates in order to make them more expensive is not at all a precautionary movement for finance and economy, since money become more expensive and thus, only the biggest capitals may arrive to use them; but all these tactics accentuate the decrease of economic performances and economic progress. The social progress – through the public expenditures for culture, science, education and health care – is all the more in danger.

Fundamentally, the financial and economic crises were and are foreseen only by the Marxist thinkers[vii], certainly in their own cultural temporal interval. So, while asking why so many economists did not foresee the (2008) crisis, the queen of Great Britain showed only the limits and sufficiency of the dominant “elites” who do never want to learn from history and to understand the social relations in a creative manner: but in a definitely (not Schumpeterian) destructive one. The same uncreative manner belongs to the present different types of mainstream economists: praising an impossible coming back of the post-war welfare state, or on the contrary, the absolutely free market, with periodical technical “corrections” and, especially, without the voices of the popular multitudes being heard.

The power of these voices is the competence of popular classes. In order to acquire this competence, they must unveil the “esoteric” language covering in fact the secrecy of the economic and financial businesses; and since today people comprehend that the secrecy is not a condition of the prosperity of finances and people, what the popular classes before the French Revolution did not understand[viii], the way toward transparent and lucid analyses, as well as Alexander the Great in front of the Gordian knot solutions, is open.

[i]See, for example, Ch. Gomel, Les causes financieres de la Révolution française. Les ministères de Turgot et de Necker, Paris, Librairie Guillaumin et Cie, 1892, where Necker (1777-1781) was the initiator of state borrows without having as support the incomes from taxes. The philosophy of Necker was just that only the borrowings do supplement the state incomes (for wars), as “extraordinary resources in difficult circumstances”, p. 252. Before him (1774-1776), Turgot made loans based on new taxes imposed to the population, but he was the pleader of “neither new taxes, nor loans”. By attaining a deceptive political security (pp. 254-255) through a simple series of new and new borrowings, Necker has exhausted the credit of France, thus fuelling the fall of the Ancien Régime.

[ii]François-Serge Lhabitant,Handbook of Hedge Funds, Chichester, England, Willey & Sons Ltd., 2006.

[iii]Yalman Onaran and John Glover,Stress Tests, June 29, 2017, https://www.bloomberg.com/quicktake/stress-tests

[v]See the important Bibliography, mostly in English, of Ana Bazac, Și din nou despre criză: a cui e panica și ce ne așteaptă?, 12 februarie 2016, http://www.criticatac.ro/28771/din-nou-despre-criz-cui-panica-ce-ne-ateapt/ [On crisis, again: who’s the panic and what’s waiting for us?]

[vi]Though Michel Aglietta, Macroéconomique financière. 1. Finance, croissance et cycles, Paris, La Découverte, 2001 (3e édition), has studied the financial practices and instruments, he considered the financial stability as a common good (including on global level) and showed that the (financial) system risk is related to the real economy and the periodical oscillation between state regulations of the financial system and freedom of monetary practices.

[vii]As Nick Beams from the World Socialist Web Site. See his last article related to the stock exchange present disorder, Wall Street plunges amid fear and panic,9 February 2018,http://www.wsws.org/en/articles/2018/02/09/mark-f09.html

[viii]Ch. Gomel, Les causes financieres de la Révolution française. Les ministères de Turgot et de Necker, p. 85.