This article was originally written in Turkish one week ago. It has since been translated into English by a comrade. This explains why the references to the performance of the stock market seem somewhat dated. Yet everything that was said on the manic-depressive mood of the stock exchange has since been confirmed amply. In any case, the long term analysis and prognosis is the more fundamental aspect of the article.

Wall Street got shut down for the second time within four days on Thursday, March 12th. If the largest based index among the major three, S&P 500, falls by 7%, an automatic mechanism called the “circuit breaker” shuts down the stock market for 15 minutes to cool nerves. When this happened last Monday (March 9th), some claimed that it would be recorded in history as “Red Monday”. This label obviously entails a reference to the “Black Tuesday” of the notorious stock market crash of 1929. Yet, this time, as the same thing has occurred twice within a week, the inventors of the name might have additional tasks: “Red Monday”, then maybe “Orange Thursday”, then…

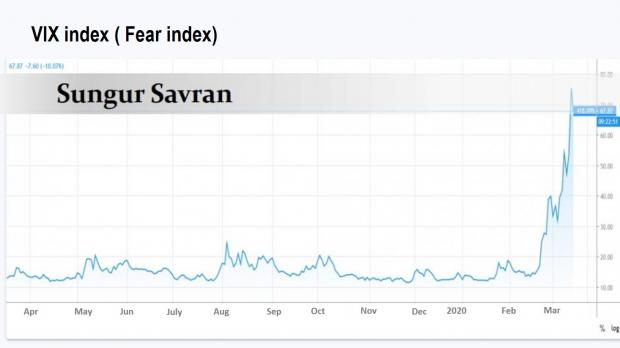

In the last few weeks, a manic-depressive mood has seized Wall Street. The Dow Jones Industrial Index fell or rose by more than 1,000 points on six days within several weeks. A rare instance for the stock markets, this fluctuation hints at a deeper and more serious problem. The stock market is under downward pressure due to the larger economic forces. However, the big players in the market are unwilling to accept this. The simplest positive signal that follows a great drop creates the hope for a new rise for these players. When Fed lowers the interest rate or when a positive economic indicator is announced etc., the stock market rises like a patient in their deathbed showing indications of recovery – only to crash again after a few days! The photo above shows the development of the VIX Index, reflecting market volatility. The month of March is a month of horror! This index is also popularly called “the fear index”, for it reflects the fears and worries of the stock market players. As one can see, the index is almost around 80. It had hit 90 when Lehman Brothers collapsed in September 2008.

The stock market has been on the rise for a very long time, with exceptional ups and downs now and then. Wall Street and the world stock markets have been experiencing a long, 11-year upward wave (“bull run”) since 2009. This, to our knowledge, is a historic record. After the great financial crash of 2008, both Fed and the other main central banks of the world flooded the market with liquidity, leading to a flow of money into the stock market. This aura of happiness lasted until recently. When the curve for S&P 500 is superimposed on the curve that shows the growth in Fed’s balance-sheet (one of the clearest indicators of cheap money policy), the two curves appear almost as one identical graph – the relation couldn’t have been more obvious!

Yet, since the Third Great Depression that started in 2008 has not been superseded, the situation described above would mean a new bubble. What has burst now is this very bubble. This is the reality that the stock market is refusing to admit and the reason behind its spasmodic development.

Yet the net tendency is downward. Dow Jones has already lost above 20% of its net value. In the technical literature, such a situation is defined as the initiation of an era of fall or a “bear market”. Of course, our world is integrated through the internationalization of financial markets; and thus Wall Street is not the only one that has crashed. Big stock markets such as Tokyo, Shanghai, Hong Kong, Frankfurt, and London, as well as smaller ones,have their share of this tendency of collapse. What this means is that a new recession or at least a slowdown of the world economy is on the horizon.

Yet, there is one factor that sets this financial crisis apart from others: this crash cannot be separated from the havoc in the world economy caused by the Coronavirus. Here we come across an ironic issue: for the last two and a half centuries, the spokespeople of capital have always tried to explain away the causes of every major financial crash or economic crisis with unique, unrepeatable factors that come from outside of the capitalist system. This has always been an apology transparent enough for us Marxists to ridicule. Even some representatives of the system have at times ridiculed it. For instance, during the 2008 crash, two well-known American economists (Reinhardt and Rogoff) titled their book on crisesThis Time is Different,mocking such attitude towards crises.

However, this time isdifferent. How and in what sense is it different? Let us see.

Coronavirus and Capitalist Virus

We fully understand why the ideologues of capitalism try to explain away crashes and crises with different and non-systemic factors each time they occur. Capitalism, as Marx emphasizes, is a system that develops, expands, and grows with and even through crises, due to its systemic qualities, i.e. the intrinsic dialectic of generalized commodity production. Moreover, as capitalism develops and enhances productive forces, crisis tendencies become stronger rather than weaker. The series of Great Depressions, of which we are experiencing the third today (1873-1896, 1929-1948, 2008-no end in sight yet) is an expression of economic crises becoming crises of the system itself.

While Marx explained this fact early on, bourgeois economics has always based its mainstream theory on crisis denial. Why is that so? Because bourgeois economics has devoted itself to an apology of capitalism, to make it appear as the best possible of all economic systems and the economic form that is best suited to human nature. Since “neoclassical economics”, i.e. mainstream economic theory, lacks any means to explain crises through the qualities of the system itself, all its practitioners could do has always been to say “this time is different”. The difference, in turn, is always in the “external shocks” coming from outside of the system, since, as it goes, the system itself has no tendency toward crisis! That is to say, the apology does not emerge at the moment of crisis only. It is built into the science of bourgeois economics from its inception onwards.

The greatest exception is Keynes. Keynes is different from the rest precisely because he accepts theoretically the possibility of crises. Yet, not only does he seek the reason for this possibility in the wrong direction (circulation rather than production, aggregate demand, animal spirits of individual capitalists, etc.), but he also implies that crises can be prevented through the right policy mix. This is precisely the essence of what was later constituted as Keynesianism: the art of preventing crises and, if they cannot be prevented, of fixing the system upon the onset of the crisis. The difference of this approach from that of Marx is obvious: in Marxist theory, crises cannot be prevented; in the era of imperialism, i.e. in an era of historical decay, neither can they be regulated through demand management, etc.

Why did we explain all this? Because we mock and ridicule the traditional attitude bourgeois economics takes in the face of crises. But we do not need false proofs for this – we simply tell the truth. Capitalism is complicit in the pandemic of Coronavirus. It may not have created the virus. But capitalism accelerates its spread freely to take the form of an absolute doom to claim hundreds, thousands, maybe millions of lives through a thousand cracks it has inflicted on the health care system, from shortages of medical kits to those of medicine or vaccine.

Yet this pandemic is not a typical example of systemic crisis-generating mechanisms. Neither it is possible to deny the role of the virus in the emergence of today’s financial crash. The conclusion to be reached, then, is clear: this particular crash of the stock market is triggered by a factor from without. In this sense, and in this sense only, is this time different.

A new phase of the Third Great Depression

But the difference stops there. The ideologues of capitalism will be lying when they hold solely the Coronavirus responsible for the financial crash and the tremors in the real economy that will definitely follow. The so-called “global finance crisis” set off in 2008, i.e. the Third Great Depression, has only been postponed, not resolved or superseded. That is why the Coronavirus dealt a big blow to the world economy and the stock market.

The 12 years of the Third Great Depression have witnessed a process in which the crisis has jumped from region to region, seizing a different sphere each time. The process went through easily discernable phases. First, in 2008-2009, the Central Banks pulled the stock markets, banks, insurance companies and all other big financial institutions from the brink of the abyss. In a second phase the crisis of private finance turned into the fiscal crisis of the state, due to policies of supporting the economy by printing unbacked money and deficit spending and borrowing. This crisis is still at play. All the states of the capitalist world are suffocated by the greatest burden of debt peacetime history has witnessed.

In the initial period of the crisis, China and some “emerging economies” (first and foremost other members of the so-called BRICS, i.e. Brazil, Russia, India and South Africa, alongside China) seized the opportunity of a great wave of capital inflows out of the crisis-ridden developed capitalist countries and thanks to this attained very high levels of growth. However, this flow got reversed after 2013. The Fed gradually stopped (“tapering”) printing unbacked money against the risk of a new bubble in the stock market. Later, it started to raise interest rates. With the reversal of capital flows, the “emerging economies” started to bleed. This was the onset of the third period. The “emerging economies”, excepting China, went into crisis one by one: Russia, Brazil, Turkey, Argentina, South Africa and other similar countries shifted from rapid growth in different tempos to economic recession.

China resisted for some time, because its growth was not premised on volatile foreign capital flows. Yet in a world in chaos, for how long can a country with deep links with that world resist, no matter how much of its economy is under the state’s deliberate control? China experienced an economic earthquake in the years 2015-2016. The Shanghai bourse crashed three times in June 2015, September 2015, and January 2016, losing half of its market value. Yet each time the state prevented growth from slowing down by increasing its spending and pumping credit from the state-owned banks.

Hence the only exception finally joined the convoy. The third period had reached its logical conclusion. Now, all that was left to do was to wait for the world economy to collapse again. What has blown away with a single stroke of the Coronavirus is this weak world economy.

The Coronavirus theory of crisis of and petroleum prices

Let us consider the struggle over petroleum as an example. It was not only the stock markets that crashed last Monday (i.e. the so-called “Red Monday”). The price of oil also fell by 30% around the world market. Oil companies were dealt a hard blow in the stock exchange: Shell’s stocks fell by 14%, and those of British Petroleum by 18%, in a single day. The first impression would be that oil prices fell due to the blow the Coronavirus dealt tourism and the general anxiety about traveling strangling airlines. That is what the proponents of the Coronavirus theory would say.

Yet a broader look at the movement of petroleum prices sheds a different light on the situation. Initially, oil prices rose sharply in the years 1974 and 1979. The reduction of supply by the Organization of Petroleum Exporting Countries (OPEC) through agreements and quotas to prevent competition between the producers to drive down prices played an important role in this rise. A sellers’ cartel was thus established. Then at the beginning of the 21st Century, oil prices skyrocketed. Brent petroleum rose from $25 to $160 per barrel. This was the time when Chávez claimed that he was establishing “socialism” with oil money (there is no doubt that he was spending the money on the poor; the problem was that this was labeled “socialism”!). This was also the time when Putin overcame the economic collapse of Yeltsin’s period and consolidated his power. And this was also the time when Bouteflika was increasing the Algerian government’s spending for people’s needs while at the same time creating a class of capitalists who were completely dependent on himself.

Oil prices were hit hard for the first time in the new century during the 2008 financial crisis, the onset of the Third Great Depression. The price per barrel rapidly fell as low as $50. Yet as soon as the states started to make the economy float again on an ocean of cheap money and debt, the price rose anew and settled around $100-125 for some years. Let us now take a step back and reflect: a crisis compared to the Great Depression of the 1930s not only by us the Marxists, but even by many bourgeois economists (though they have never dared call this a “depression”) has broken out; yet the oil price falls only from $150 to about $100-125 (with a lag of a single year). Can this be normal pricing? If not, why the anomaly? Because the economy has been put on its feet through artificial respiration. And here is the price: when the day of crisis comes back, the collapse is harder and deeper. The longer the period of artificial respiration, the harder the new crisis hits. We have already touched upon the exceptional longevity (already 11 years) of the stock market rally. What lies behind this? To reiterate: The central banks’ policy of negative interest rates and issuing unbacked money under the hypocrisy of “quantitative easing” (in the second half of the period with the exception of Fed). The imperialist-capitalist states have blown up the bubble with their own hands. What is bursting now with the stroke of the Coronavirus is this bubble. Now, these same central banks are taking palliative measures. The Fed is lowering interest rates rapidly, because it has had room to raise interest rates due to a relative recovery in the American economy in the past. But take a look at the Central Bank of Europe: just yesterday, the new chair of the Bank and former IMF managing director Christine Lagarde announced a new package of measures. Yet the package was so insufficient that the stocks fell further! Why? Because the Central Bank of Europe has been charging negative interest rates to this day, 12 years after 2008; i.e. it gives out money to borrowers rather than charge them interest! If that is the case, what else could it have done today? This shows the limits central banks face in the new crisis.

Now let us pick up the story from where we have left off. We had addressed the skyrocketing of oil prices between 2010 and 2014. The year 2014 witnessed a second and much more permanent blow. Why? There are multiple reasons, but two stand out. The first is directly related to this article’s overall argument. As we have noted above, the “emerging economies” started to overheat and then stagnate after the years 2013-2014. Finally, the slowing down of the Chinese economy was a hard blow on all raw materials, especially primary energy sources, and thereby petroleum, on which China is heavily dependent. After 2014, oil prices fell to $50 or even below – this time to stay there. This new period, i.e. the third phase of the Third Great Depression, was when Maduro acclimatized the people of Venezuela to poverty because of the collapse of oil revenues. This was also when Russia experienced an economic crisis akin to the moratorium in 1998. This was also when Bouteflika was overthrown in a revolution. And what was the reason for all these? The reason was that the weakness of the world economy and the formation of bubbles in the stock market were becoming more and more apparent!

The other reason is somewhat secondary for our purposes here. In some imperialist countries, especially in the USA, the increase in oil production through “fracking” (i.e. oil and gas extraction from shale) created a tendency to make these countries into net oil exporters again. What this meant for the traditional producers was the emergence of a new competing actor on the horizon. Fracking entails higher unit costs than drilling, however. A considerable fall in prices would lead those producers practicing fracking to losses and, over time, drive them out of business. Saudi Arabia, the foremost oil producer, has demonstrated that it is more willing to reduce its price by increasing its output to out-compete its competitors rather than risking its share of the market. The second producer Russia, due to its much different and more complex economic make-up (including armaments and space industry, a highly developed scientific-technological sector, many other kinds of natural resources, including gold etc.), did not wish to give Saudi Arabia a free hand. Hence, due to the competition within the US-Saudi-Russia triangle, oil prices fell by 30%. Yet, pay attention! This year’s decrease is even higher: since January 1st, the price has fallen already by about 45%. That is to say, in two and a half months, the oil price has decreased almost by half. Before that, it was already floating around $50-60 per barrel. Now this is a clear expression that the demand for oil has been on a declining trend in past years as well, which, in turn, is a sign of the weakness of the world economy. The Coronavirus itself, on the other hand, has been on the agenda only for the last three months, let alone the month-old pandemic. Yet oil prices have been going down and down for the last five years.

The following figures would be enough to demonstrate the role of China’s stagnation in this weakness. In the year 2019, China consumed 14 million barrels of oil per day. The aggregate world consumption was 100 million barrels per day – so China had a share of 14%. Yet there is an even more important piece of data: 80% of the increasein demand came from China! Now China is stagnating heavily due to the combined impact of economic weaknesses that were covered up through palliative solutions and the harm the Coronavirus has inflicted upon production and consumption. It is now predicted that the Chinese economy will grow around 2.3% in the first quarter of 2020, rather than the previous estimate of 6%.

If the world economy goes down when China goes down, that means that the world economy has already shipwrecked. From its inception onwards, we have been pointing out that the Third Great Depression has two historical peculiarities that set it apart from the previous two: the oxygen tents the states set up since day one, and even more importantly, the rapid growth of the gigantic Chinese economy. Has the capitalist world built its world economic order relying on China? Now the exceptional dynamic that China had set in motion is evaporating and the world is facing the bitter truth of the Third Great Depression!

Let us sum up then. The “Coronavirus theory” is wrong because neither the fragility of the stock market nor the decline of oil prices have emerged from one day to another. These phenomena are the proof that the world economy has been on a decline once again heading for bust since 2013-2014. There were attempts to circumvent this recession through artificial respiration – effective only to a limited extent. The Coronavirus has razed capitalism’s oxygen tent to the ground, tearing the glitter on the surface of the truth off and exposing capitalism in its naked truth. That, and only that, has been the role of the Coronavirus. The virus has not created the crisis, but has merely triggered it.

Red Monday

In the jargon of accounting, “red” stands for deficit and in stock exchange jargon for stocks rapidly losing value. This should be the reason for some on Wall Street calling March 9th “Red Monday”. Yet in Turkish this phrase gains a special flavor.

The title of a famous novel of the great Colombian “magical-realist” novelist Gabriel Garcia Marquez translates as “The Chronicle of a Death Foretold”. In English as well as most western languages, the title is translated roughly with these same words. Yet for whatever reason, the Turkish translation bears the title “Red Monday”. Thus the irony: the name some Wall Street pundits attached to March 9th signifies in Turkish that this death was foretold and revealed! Yes, the murder was foretold. The capitalist states have been keeping the economy going for a dozen years through palliative, artificial measures. The stock markets had been on an artificial boom due to cheap money and debt policies. A new burst of the bubble was a matter of time. And now, that day has arrived.

Let us point to another irony. Our party, the Revolutionary Workers’ Party (Devrimci İşçi Partisi or DIP), programmatically rejects the domination of the entire economy by the stock market (quite akin to a casino) in our age of vast space expeditions and nanotechnology able to move particles so small as to be absolutely invisible to the eye. We have therefore enshrined in our program the slogan “Shut down the stock market!” (obviously not used under ordinary circumstances in daily agitation). Now, under the weight of the contradictions of the world capitalist system, the center of the entire global stock market – Wall Street – shuts itself down (albeit temporarily)! As Marx had said, “the greatest barrier to capital is capital itself”. We see this current economic crisis as a symptom of capital’s historical decay. Today, the stock market shuts itself down temporarily; but when it opens up again, it will cause even more trouble. What capital cannot do, the proletariat shall accomplish: shutting down the stock market irreversibly, socializing all banks and finance institutions under one central state-owned bank, regulating the allocation of resources at all levels of the economy according to the society’s self-decided needs, and thus carrying humanity forward in a planned manner until the day when money vanishes from existence. We see the correctness of this program with practical clarity. The stock exchange is dangerous and harmful.

The fourth phase begins

The first phase of the Third Great Depression was a time of all capitalist states running to the service of the common interests of capital (2008-2009). An oxygen tent was set up, yet it was very costly. The second phase (2010-2013) was that of the states themselves descending into a fiscal crisis due to their efforts to patch up for the loss of capital. Then, some of the representatives of capital – first and foremost, the Fed - remembered the famous phrase “there is no such thing as a free lunch”, and took measures against a possible new crash. This initiated the third phase (2013-2020). So-called “decoupling”, a differentiation in growth performance within the crisis between the different categories of economies progressively disappeared, and the “emerging economies” slumped one by one, and finally, China also joined the caravan of descent.

What we have entered today is the fourth phase. This phase will be that of the disappearance of the historical peculiarities that set apart the Third Great Depression from the first two, laying bare the nature of the epoch without any makeup. Up to the present, the Depression had unfolded like a slow-motion film. Now, everything will gain pace.

When the Third Great Depression initially broke out, we had predicted the beginning of a new phase in class struggle, in which both fascism and revolution, we said, would rise. Now fascism will make a meteoric ascendancy in certain countries. Trump, Brexit, Marine Le Pen, Salvini, and the likes have already been pumping the illusion that nations can protect their interests best by closing themselves up to the outside world. Now this illusion is reaching its zenith with the Coronavirus, something that appears to everyone as an external threat (except for China). Trump’s decision to shut down the nation’s doors to European travelers is the product of the same vibrations that have generated his longing for the wall on the Mexican border and the so-called “Muslim Ban”. Yet, everyone will soon feel the urge to open up again, since closing up on oneself is no more possible in our age – though that opening will come not with the new cultural tools that the postmodernists praise so highly, but with the same old, well-known tools of mass destruction, with weapons strong enough to wipe out humanity and even the whole of nature. For whoever says “fascism” is also saying “world war”!

Yet we are entering this new phase with the third wave of world revolution already roaring in some parts of the world. The working class, the toiling and oppressed masses have been revolting from Tunisia and Egypt to Algeria and Chile; the confidence in bourgeois states is crumbling; the people are searching for their own path forward. Huge masses of people are increasingly seeking for the way out of the impasse capitalism has brought about in revolution.

Let everyone take stock! Demoralization is understandable only up to a certain point. 30 years have gone by since the collapse of the Soviet Union and all the other bureaucratically degenerated workers’ states, with one or two exceptions. Those who have abandoned Marxism, degraded Leninism, turned their backs on the working class and struggled endlessly against the idea of the party in a post-Leninist manner must come back to their senses. We may not be agreeing on why those bureaucratically degenerated workers’ states have collapsed. We can and we will discuss further. But Marxism has once again been historically vindicated. Capitalism, just as the Communist Manifesto and Capital so adorably demonstrate, is leading humanity into an apocalypse just when humanity is able, thanks to the level of its productive forces, to make a gigantic leap into a brand new social order. Capitalism needs to be smashed. Only the working class can do that by gathering around itself all those who are oppressed. That, in turn, takes a Leninist party to accomplish. Once again, the crisis of humanity is being reduced to the crisis of revolutionary leadership.

The final day of reckoning is nearing. What will save humanity from both capitalism and the Coronavirus is – revolution.

13 Mart 2020